My journey to saving time using Tableau for finance analytics

Editor’s Note: Sam’s background is in creating financial functions for InterWorks, which includes performance analysis reporting. This post is based on his original blogs included in the “Tableau for Finance” series published by InterWorks.

What is the most valuable commodity for your finance team? You might say people. Assuming you have the right people, with the right skills, in the right jobs, then what would be your answer? Mine is time.

Time is scarce in my world and I'm sure many finance teams have the same challenge. In my experience, finance departments work with stoicism and perseverance to produce reports within tough deadlines. But do we consider if stoicism and perseverance lead to optimal use of time and alleviate the pressure applied when time is tight? I want to explore this question and spotlight a resource that’s created great value for me, my team and company.

The safety and limits of Excel

A large portion of the reports created by finance are developed in Excel. It’s the go-to resource and safe haven. Historically, Excel has offered functions that easily adapt in formulae.

I've lost count of the workbooks that I created in Excel, now frozen in time because they are just a snapshot versus aggregate of real-time data.

I’ve realized the major limitation of Excel is how quickly reports are outdated as new transactions or adjustments post in our accounting system and the repetitiveness of running them again. Precious time is wasted before I even explain a multi-sheet workbook to end users—who may or may not be Excel-savvy.

Formulas also need to be checked, report accuracy reviewed, and added data or changes to the way management wants to view the report processed. I often do this at once because of the time requirements—and reporting and analysis is just one part of my role.

Yes, I’m proud of building a complex formula which nests aggregations, LOOKUPS, IF statements, combines data from multiple sheets, and is 20 lines long because it looks like art!

But as formulas get longer and draw from multiple sources, controlling and retaining accuracy becomes difficult. In a perfect world, the source’s data shape doesn't change, and you just import fresh data, but that rarely happens.

Excel eventually hits critical mass and CRASHES! Work is lost, and more time is spent trying to recover everything. The good news is those problems don't have to exist if you use Tableau.

Automation and time savings achieved with Tableau

Tableau returns time to finance and operation teams. I’ve experienced it. It also saves time for those using reports as we co-build and collaborate on them to increase interaction and understanding.

My background is accounting; I can’t code or write scripts. It took me some time to adapt to Tableau for reporting and analytics. But am I glad I took the plunge? Yes, and I wish I had sooner. Don't get me wrong; Excel still exists in my world, but it performs a different function. Tableau is my go-to solution.

How does Tableau save time?

My day consists of cramming 10 hours of work into an eight-hour day. If I weren’t using Tableau, I'd cram 20 hours into an eight-hour day. I’d like to highlight some critical functions of Tableau that benefit me and can benefit you.

Live data connections

Your first reaction may be: How can I connect live to company data? A key Tableau feature is data source connections, which don't require coding. You can connect to most databases, if you have the right permissions (like in the image below). With a live connection to your CRM, Tableau reports update in real time or on a schedule. And if you’re set on using an Excel spreadsheet, you can also connect to those. Below is the first screen you see when launching Tableau:

Above: The first Tableau screen shows a selection of data source connections.

Automation

How many of your reports are manually produced in Excel monthly? The number of reports isn't important; rather, it's the time invested in them doing data prep, formula building, data checking and production?

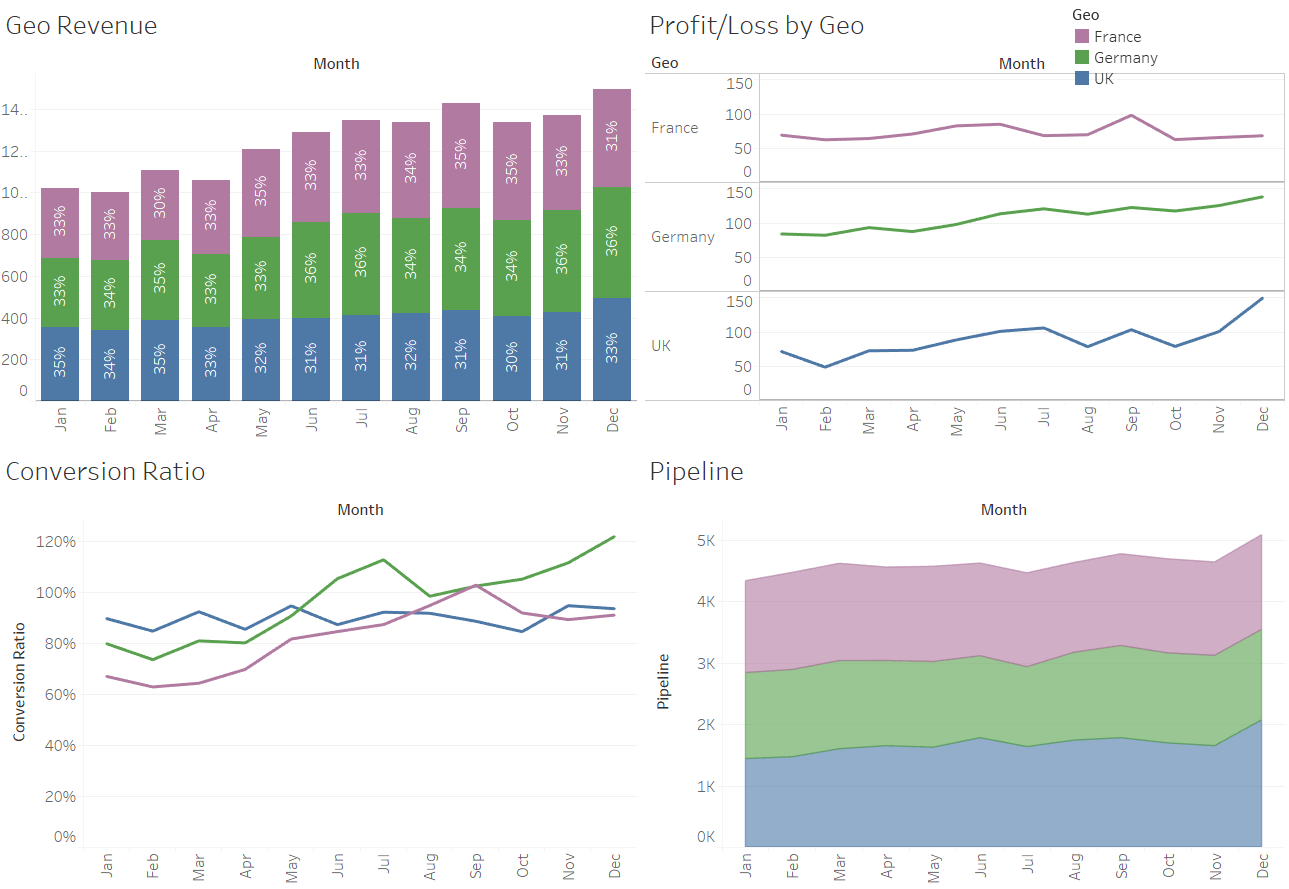

Tableau performs all the data updates to save considerable time. We’ve published several dashboards that are split into two categories: performance and compliance reporting. Insights from the data inform our decisions, so we want up-to-date data in the hands of decision makers.

Whatever your reporting needs, a dashboard made and published with Tableau supports self-service analytics. Minimal maintenance is required with automated data refreshes or filtering to isolate aspects of the analysis most relevant to your audience.

As an example, could an Excel workbook:

- Automatically update every hour

- Provide users 24/7 report access by browser

- Enable filtering of data by individuals

- Offer subscription so users automatically receive it daily

- Have different edit, interaction and download permissions based on user credentials

Unions, joins and blending

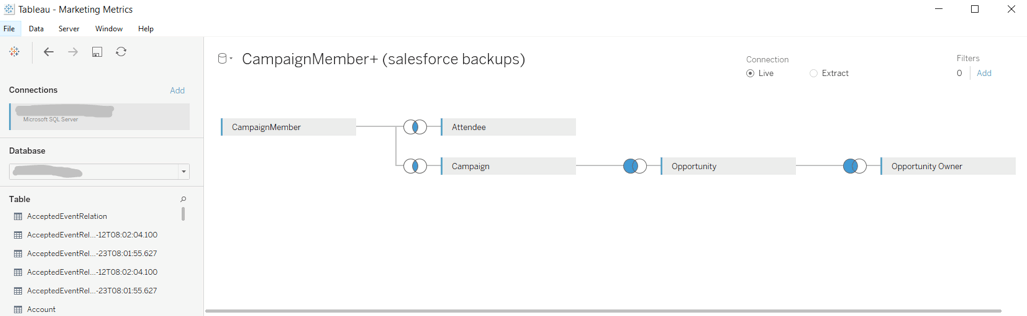

Once you've connected to a data source, you'll see all the sheets or tables in your database that can be joined. In Excel, you'd have to consider VLOOKUPS, SUMIFS or cross-sheet links from other formulae.

Once you decipher the framework of the union or join, Tableau remembers your choice for future use. No need to update lookups and audit formulae when rows or columns are added.

This view reflects multiple tables from Salesforce that are joined together by a simple drag-and-drop feature.

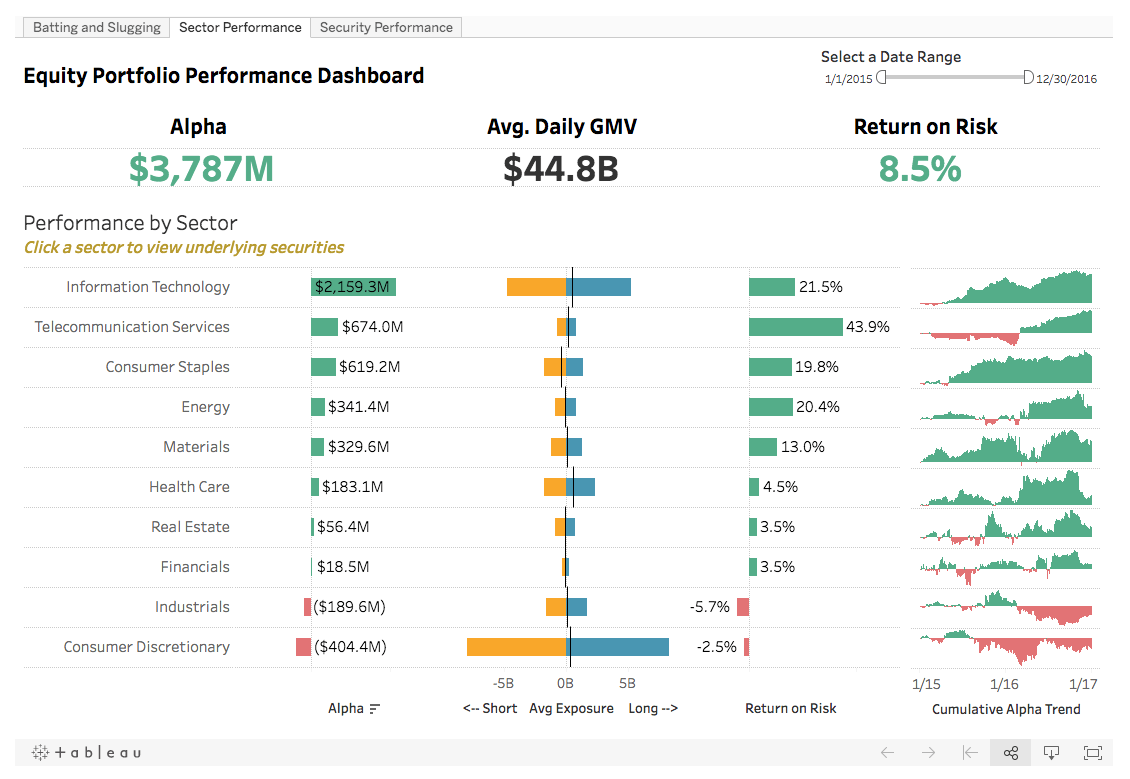

This dashboard allows teams to view equity performance by sector and get details on the underlying securities.

The three functions highlighted above have transformed the way I work with financial data, but I’m just scratching the surface of what Tableau can do. The deeper I dive into the platform, the more value I find. If you want to learn more ways that Tableau’s visual analytics can drive value and return time to your finance teams, read the full report here.

It may be unfamiliar territory, but you'll realize how easy it is to get started.

เรื่องราวที่เกี่ยวข้อง

Subscribe to our blog

รับอัปเดต Tableau ล่าสุดในกล่องข้อความ