Data isn’t enough to improve the insurance customer experience

The insurance industry has always been driven by data. Without it, measuring and managing risk would be an impractical and ineffective business model. As technology continues to advance, especially in a hyper-digitized, post-pandemic world, more and more data is available about insurance customers. And there’s a big push in the industry to use that data to improve customer experiences.

It’s not just the industry that wants better customer experiences: 80% of consumers say the experience a company provides is as important as its products.

But data alone isn’t enough to improve customer experiences. You also need reliable software to collect, curate, organize, analyze, and share that data. And you need your entire company to base their day-to-day decisions on data. At Tableau, we call that Data Culture—and we believe it’s essential for unlocking the power of your data and your people.

Here are three ways that combining Data Culture with a robust data analytics platform can help you improve customer experiences.

1. Streamlined interactions

It’s no secret that customer expectations for streamlined interactions with insurance companies are rising. The Deloitte 2021 Insurance Outlook report identified customer experience as one of the highest priorities for industry leaders:

“Generating continuous innovation in insurance policies, sales strategies, operations, and customer experience could turn out to be the biggest differentiator in 2020 and beyond.”

Removing friction and delivering faster, more personalized customer interactions is no small task—especially with siloed data storage and analytics. When relevant customer information is scattered across programs and departments—from marketing and finance to actuaries and claims—using that data to improve a customer’s experience is effectively a non-starter.

With Tableau, you can integrate all of your insurance company’s data sources into one platform. The resulting single source of truth for customer data streamlines touchpoints at every step of the customer journey. Marketers can provide timelier, more personalized messaging. Sales teams can deliver customized offerings. Analysts can provide better-informed risk measurement and scoring. Underwriters can save significant time and resources, and product managers can recognize trends and strategies that lead to stronger performance.

All these faster, more personalized touchpoints drive loyalty and trust by making your customers feel seen and valued.

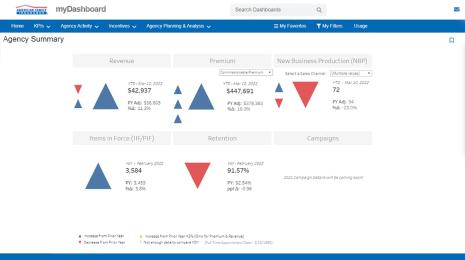

This sample Tableau dashboard provides managers with a high-level summary of live customer performance data including attrition risks, lines of business, and premiums at risk by region.

2. Optimized IoT

Few insurance industry technologies are likely to produce as much data in the next 10 years as the internet of things (IoT). From health-monitoring wearable devices in life insurance and telematics for car insurance to performance-monitoring programs on high-tech equipment at nuclear energy plants, IoT data enables insurance companies to reduce risk and allows insurance customers to save on premiums.

But like all insurance data, the information collected from IoT technology on its own is not an efficient source of value. It must be paired with a robust data analytics platform and a Data Culture that normalizes data-driven decision making.

Think of it this way—Data Culture is about incorporating data-based insights into everyday decisions. And a business intelligence and data analytics platform like Tableau makes the data generated by IoT easy to find, analyze, and leverage. It adds bricks and signposts on the otherwise overgrown path from IoT to improved customer experiences.

From a customer perspective, an effective IoT program does more than just reduce premiums. It gives people a sense of control and agency that rewards healthy or responsible behavior. It turns an insurance policy from a safety net into a daily opportunity to save money.

This sample Tableau dashboard gives managers an overview of live-product performance data including market share by region, direct written premiums, and policies in force.

3. Proactive engagement

Data Culture and the right data analytics platform can also improve customer experiences by empowering customer-facing employees to shift from reactive to proactive customer engagement.

For example, Einstein Discovery, an artificial intelligence tool within Tableau, offers a look at what’s next. With all your existing customer data integrated in Tableau, Einstein Discovery can analyze customer portfolios and help identify accounts with a high risk of attrition. That insight allows marketers to create segmented campaigns designed to earn customer loyalty and improve customer retention.

Einstein Discovery can also help identify the strongest candidates for cross-selling and upselling, allowing sales teams to prioritize leads and improve ROI. Proactive customer engagements don’t just generate higher measurable results, they also create a more streamlined and personalized experience across your customers’ journey.

Download The Insurance Imperative for Growth and Resilience

Download the whitepaper to explore how a robust Data Culture empowers insurance employees, improves customer experiences, streamlines operations, reduces costs, and boosts profit margins. With industry-leading research, concrete examples, and compelling case studies, get the bricks and signposts you need on the otherwise overgrown path to building a data-driven organization.

Trusted, proven insurance industry expertise

With a data analytics and business intelligence platform like Tableau, employees at every level of your company can turn Data Culture from concept to daily practice. Underwriters, actuaries, analysts, sales teams, marketers, product managers, VPs, and C-level executives can all make faster, more informed decisions that substantially improve customer experiences.

To learn more about the Tableau platform, its enterprise use-cases, and benefits for insurance companies, read up on our insurance analytics solutions.

When it comes to customer experience, an industry-leading CRM solution is a non-negotiable. That’s where Salesforce comes in. Learn more about insurance solutions from Salesforce.

As an industry leader with experience in both data analytics and the insurance sector, Deloitte is an invaluable resource for insurance companies. Visit the Deloitte website to learn more about working with them to design and implement customized solutions to help your company successfully embrace a Data Culture.

Related stories

Subscribe to our blog

Get the latest Tableau updates in your inbox.