Mitsui Leasing visualizes risk across 177 visualizations to better improve decision-making

7 days saved on preparing risk management reports

16 employees using Tableau

177 Tableau visualizations, including income statement analysis, competitor analysis, product analysis and more

Mitsui Leasing is an automotive finance company that provides leasing solutions to both businesses and consumers across Indonesia. The company is committed to providing timely, accurate, and creative solutions for customers. This includes its one-day service, which means applicants can receive a financing decision within just one day of requirements being met.

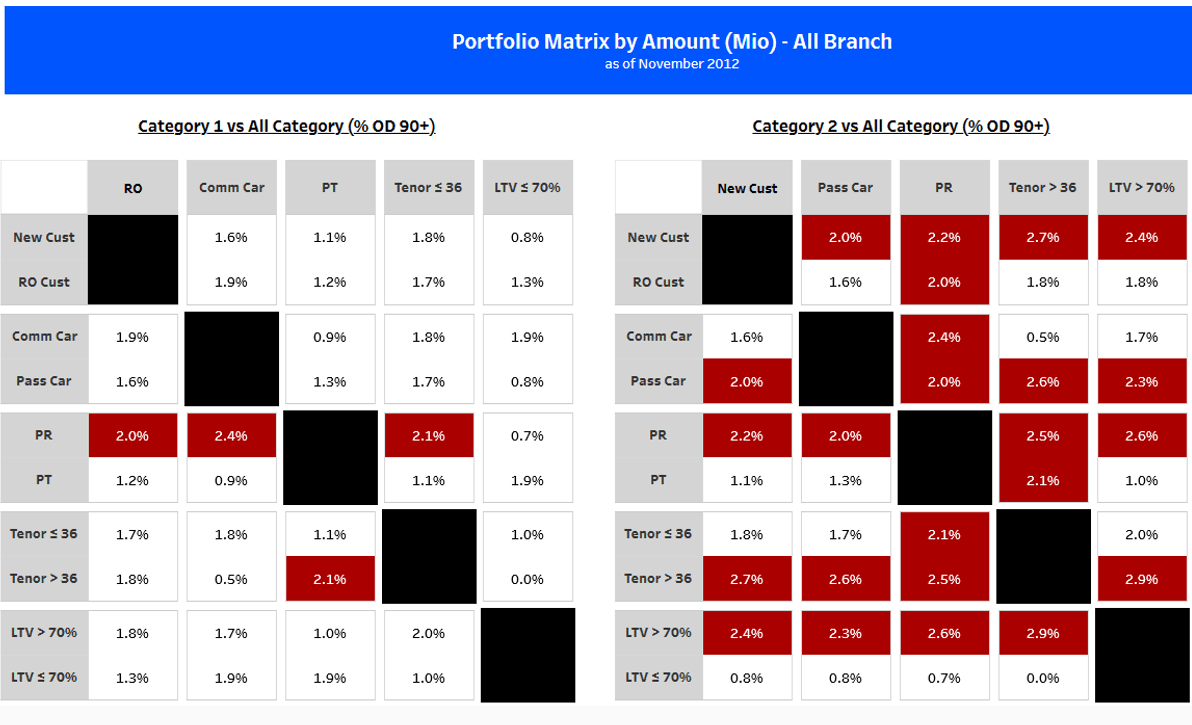

Like all companies in the finance sector, Mitsui Leasing must carefully manage its risk and ensure that any credit extended to customers will be paid back. Accordingly, the company carries out thorough analysis to understand customer risk profiles and inform decisions about each loan application.

Sandi Saebatul, Risk Management Unit Head at Mitsui Leasing, leads the team that carries out this analysis. Saebatul joined the company in 2015, and based on support from Mitsui Leasing Management one of the first things he did was bring in Tableau. His previous employer used Tableau for financial analysis, and he knew the benefits could apply to risk management.

Tableau is very valuable in helping us to identify risk and is much faster and easier to use than manual tools like spreadsheets. I can also finalize reports instantly, whereas before this took seven days.

Mitsui Leasing rolled out Tableau with the help of PC Data Visidata Anugerah Mitra, PT and now has sixteen users across Tableau Desktop and Tableau Server. Each user has authenticated access, and Mitsui Leasing has strict policies in place for data storage and governance.

Those using Tableau at Mitsui Leasing are mainly senior managers within the Risk Management Unit. They prepare analysis for teams like marketing and operations and present the findings back to them during meetings or webinars. In total, Mitsui Leasing has 177 visualizations, with most of its analysis aimed at understanding customers and providing them with the best solutions.

One of the outcomes of this has been the ability to determine a customer’s risk level more quickly and whether their application should be approved or if further due diligence is needed. They can also improve the accuracy of financing decisions and make better decisions about how to structure customers’ payments.

If a customer defaults on their obligations, Mitsui Leasing works with them to develop a corrective action plan and visualizes progress against this in Tableau. Looking at these visualizations, it typically takes just three months for the company to assess if a plan is working.

In addition, monitoring customer defaults regularly helps Mitsui Leasing understand the impact of certain strategies and its credit scoring accuracy.

In the future, Mitsui Leasing plans to analyze broader and more comprehensive data. It also plans to do more predictive analysis to understand new opportunities and risks and predict future performance.

Tableau is an excellent tool to support our business growth as it helps us to predict which customers will be profitable and make more strategic decisions about who we finance,” said Saebatul. “During COVID-19, it has been more useful for managing risk, but I think it will have an increasingly positive impact on the company in the future.