Tableau delivers ESG reporting to investment bankers ahead of regulatory demands

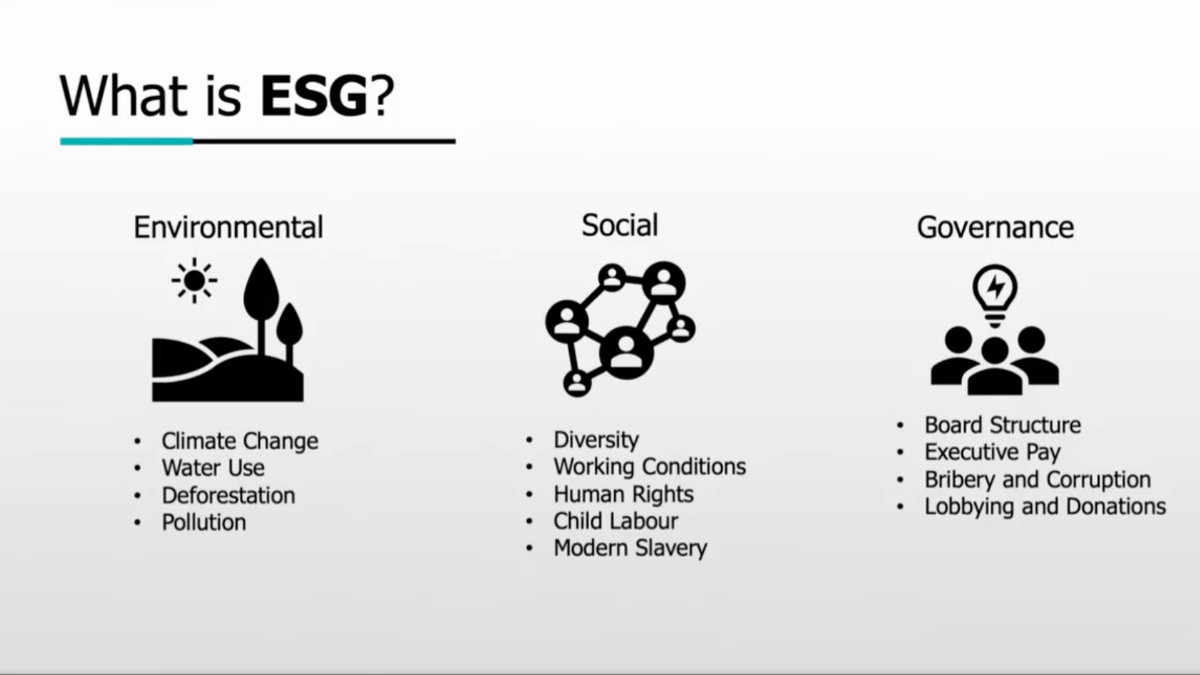

Data and information service MSCI provides financial services organisations with rich data. However, Nick Bowskill at Charles Stanley Group, a wealth management company, realised that the data needed filtering to deliver tangible results and understanding for customers and the investment managers at the London headquartered organisation. As Environmental Social Governance (ESG) becomes ever more important to investors, it has become important to Charles Stanley Group to be able to carry out an effective analysis of the ESG ratings of investments.

“ESG is not going to change the world, but it is part of the solution and gives us the opportunity to leverage the power of the financial system to encourage business to act ethically by making it profitable to do so,” says Nick Bowskill, Charles Stanley Group Business Intelligence Specialist. Come June 2024; investment managers will be required by regulations to report on the carbon ownership of the holdings they have within their investments, which will increase the importance of ESG data and reporting to organisations like Charles Stanley Group.

“Data gives us the ability to make strong decisions. It starts to hold companies accountable on issues like reducing their carbon emissions or to make changes to their supply chain,” Bowskill says of the value of ESG and its data. “This plays into transition tracking, where companies have pledged to reduce carbon emissions or to align to the Paris Agreement on climate change agreed in 2015. The ESG data allows us to see if they are on-track or if they deviate away from these. Then engagement may be useful to start to make a difference for that firm,” he says.

Bowskill says investors have options open to them now due to ESG data being available. Today investors can exclude companies from their investment programs, for example, removing oil majors from an investment portfolio. Other investors will use investing as a form of engagement and seek out companies that can become cleaner or improve their governance position.

Charles Stanley Group collates ESG data from reports published by the companies they are investing in, quantitative and qualitative research, as well as the data provided by MSCI. “ESG data is part of the information that MSCI provides, which includes information at a company, fund, and government level,” Bowskill says. For ESG reporting, MSCI data includes information on the carbon intensity and transition risks of organisations, as well as scores on their environmental, social, and governance measurements.

Data improvement

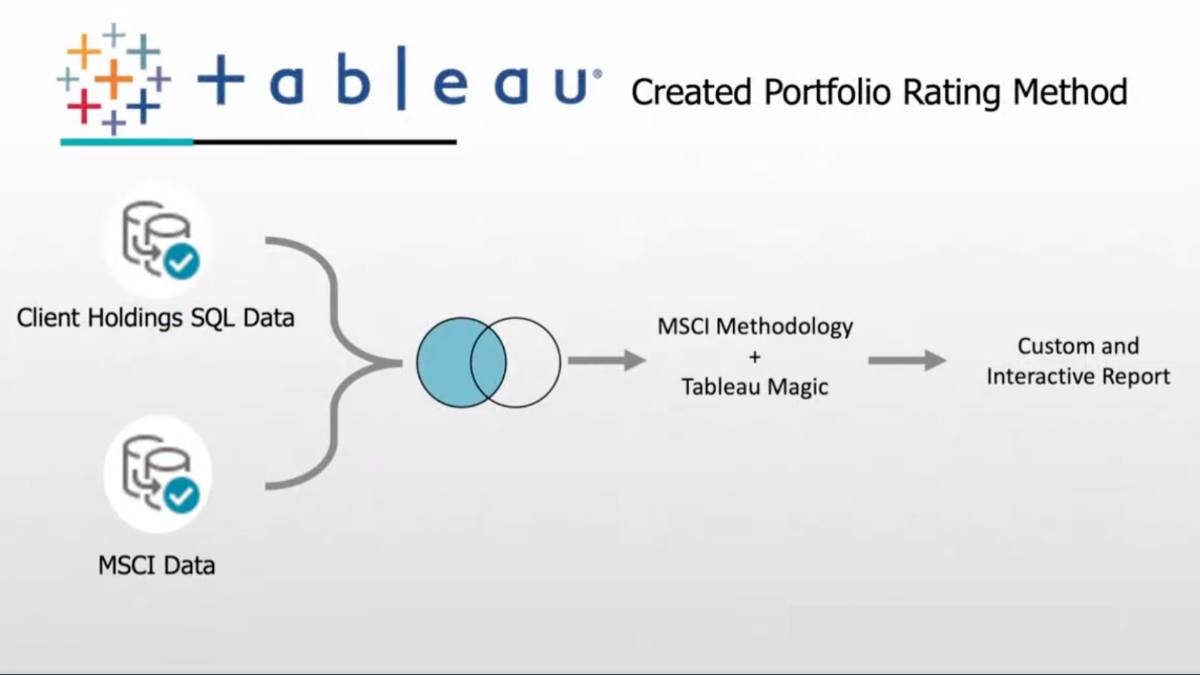

“You have to work out the weighting of a holding and then collate a report, and that works well for a single client,” Bowskill says of the limitations Charles Stanley Group was finding with the MSCI data. “Feedback from our managers was that this was not usable when they were engaging with multiple clients,” Bowskill says. For the investment managers to find the ESG weighting for each of their investment books was “unusable and discouraging,” the analytics leader says.

“I realised we had our client holding data in our SQL database and we had the MSCI data, so then we could join these using Tableau.” Bowskill did this and added the MSCI methodology for calculating ESG scoring. “We then sprinkled some Tableau magic and came up with some custom and interactive reports,” he says.

Charles Stanley Group now has ESG exposure dashboards that are connected to the Stock Exchange Daily Official List (SEDOL), a list of security identifiers used in the United Kingdom and Ireland for clearing purposes.

Using the MSCI rating, we can see which organisations achieve a triple-C through to a triple-A rating, as well as those companies that are laggards in achieving good ESG or if an organisation is falling behind the pack in their industry

“We can see our holdings distributed across these ratings, as well as if companies are getting better or worse at achieving ESG. This then plays into the portfolio rating,” he says. For the investment managers at Charles Stanley Group, they are then able to look for adjustments in performance, both positively and negatively and understand the percentage of ESG momentum improvement or decline in an investment portfolio. This means that internally Charles Stanley Group is able to rate its own portfolio. “It is the filtering, a nicely placed filter blows people’s minds, and it makes client engagement easier,” Bowskill says of how Tableau has enabled this improvement in data and analytics.

“We can now look at the underlying holdings of a client’s portfolio and see what is impacting the ESG rating of that portfolio, such as if they have some laggard companies or if there is an investment that has a downward rating and which is therefore dragging down their portfolio’s rating. This then creates the chance to talk to the client to see if this is something they are concerned about or to engage with the company that is dragging down the portfolio,” he explains how the Tableau-powered data tool is empowering investment managers and investors. Within a client’s portfolio, Bowskill reveals that investment managers can get more information on a company and how it scores on all three pillars of environment, social, and governance. For example, one investment had a set of product liability lawsuits in progress and a product recall pending, all of which reduced the ESG rating of this organisation.

Bowskill says users can analyse by investment book or client. “We have created a client page for engagement that is an A4 page of MSCI data, the client’s exposure, and also a translation into relatable data, such as 304.9 metric tons of carbon emissions in terms of miles in a petrol-powered car,” he says. “A client’s data can be updated with ease because it is connected to our SQL database."

“Feedback we have received is that investment managers asked for this level of ESG data from our risk provider, and it took 18 months, and we were able to deliver this information in just two weeks,” Bowskill says.

Related stories

Subscribe to our blog

Get the latest Tableau updates in your inbox.